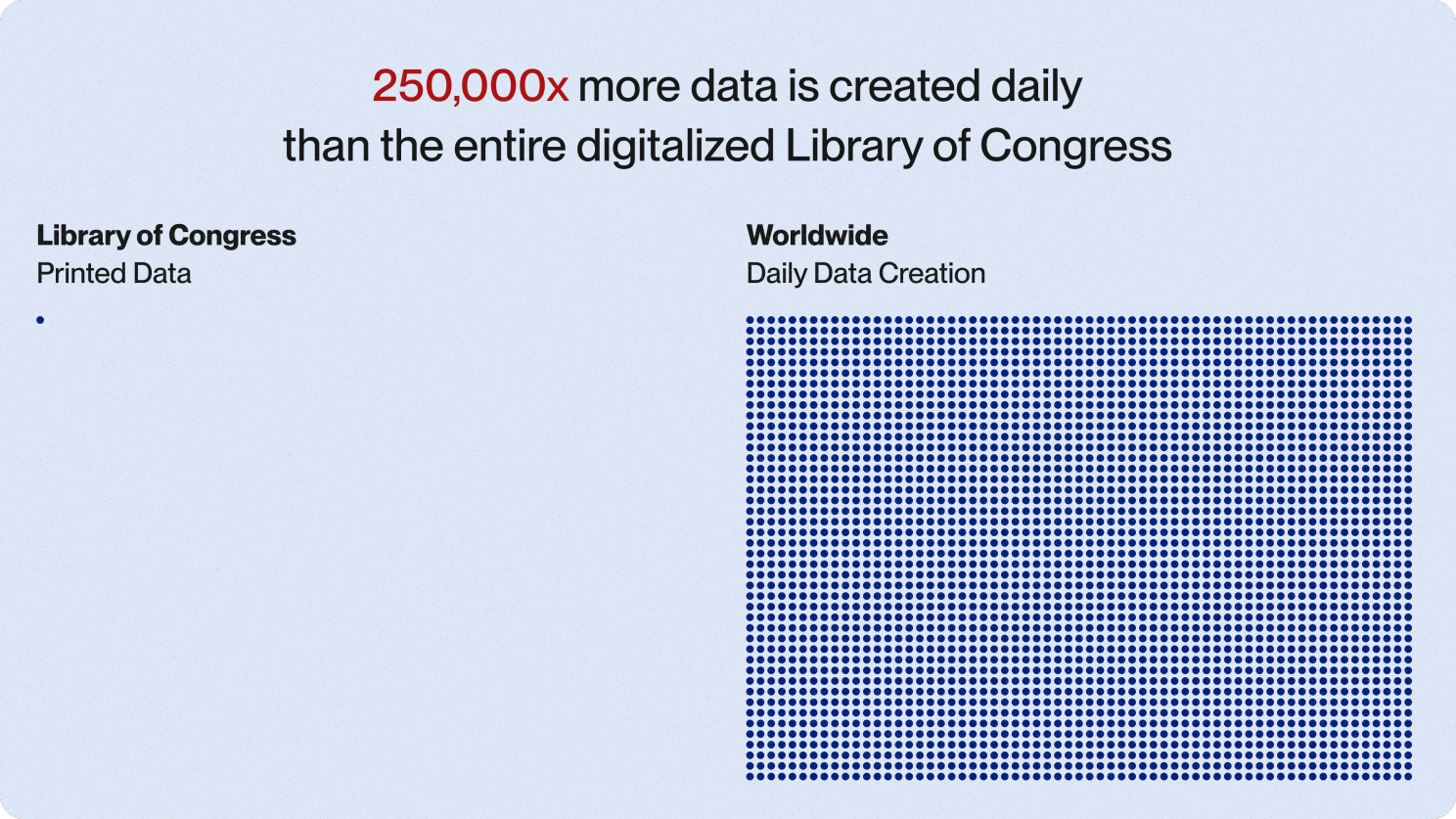

Investors today grapple with an unprecedented influx of data from diverse sources, making the efficient processing and analysis of it paramount. The growth in data volume is staggering, with 2.5 quintillion bytes of data created every day worldwide (NewYorkTimes). It's often noted that the Library of Congress contains approximately 10 terabytes (TB) of printed material. So to put that into perspective, 2.5 quintillion bytes (EB) would be equivalent to about 250,000 times the print collections of the Library of Congress. Every. Single. Day.

The Asset of Data

According to Deloitte, data should be viewed as a strategic asset requiring rigorous management. Investment management firms are inundated with data that is not only voluminous but often unstructured and scattered across various sources. This situation can lead to inefficiencies and a lack of trust in the data utilized for making strategic decisions. So how can investors stay up to date with the rapidly evolving market conditions, comprehend vast datasets, and make timely, informed decisions?

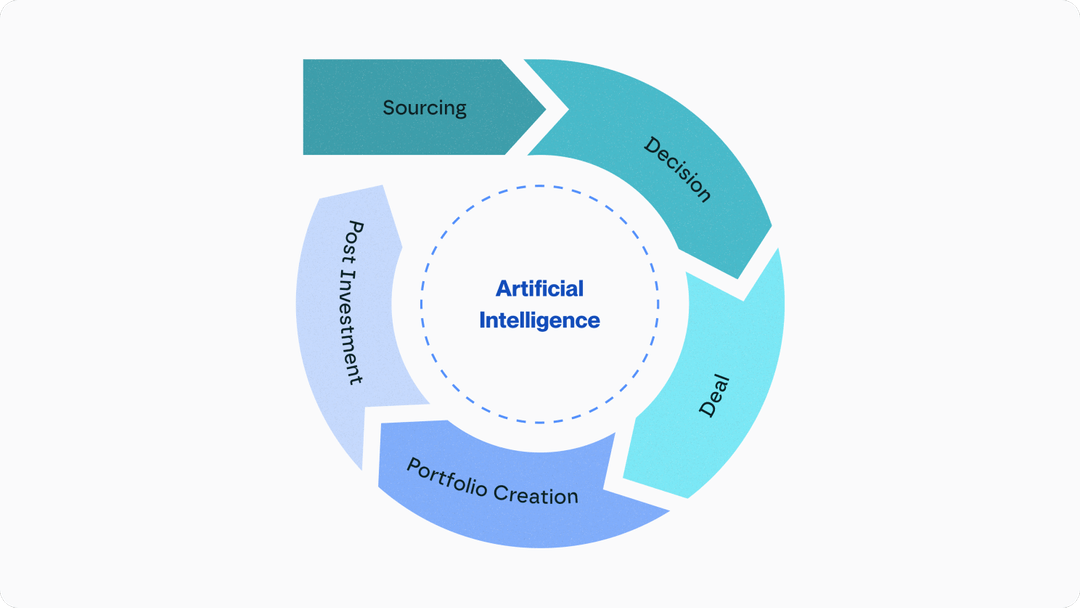

Here, Artificial Intelligence (AI) plays a transformative role by offering tools that automate and optimize data handling, ensuring investors can navigate this complex landscape efficiently. Here are just some of the use cases investors should be aware of:

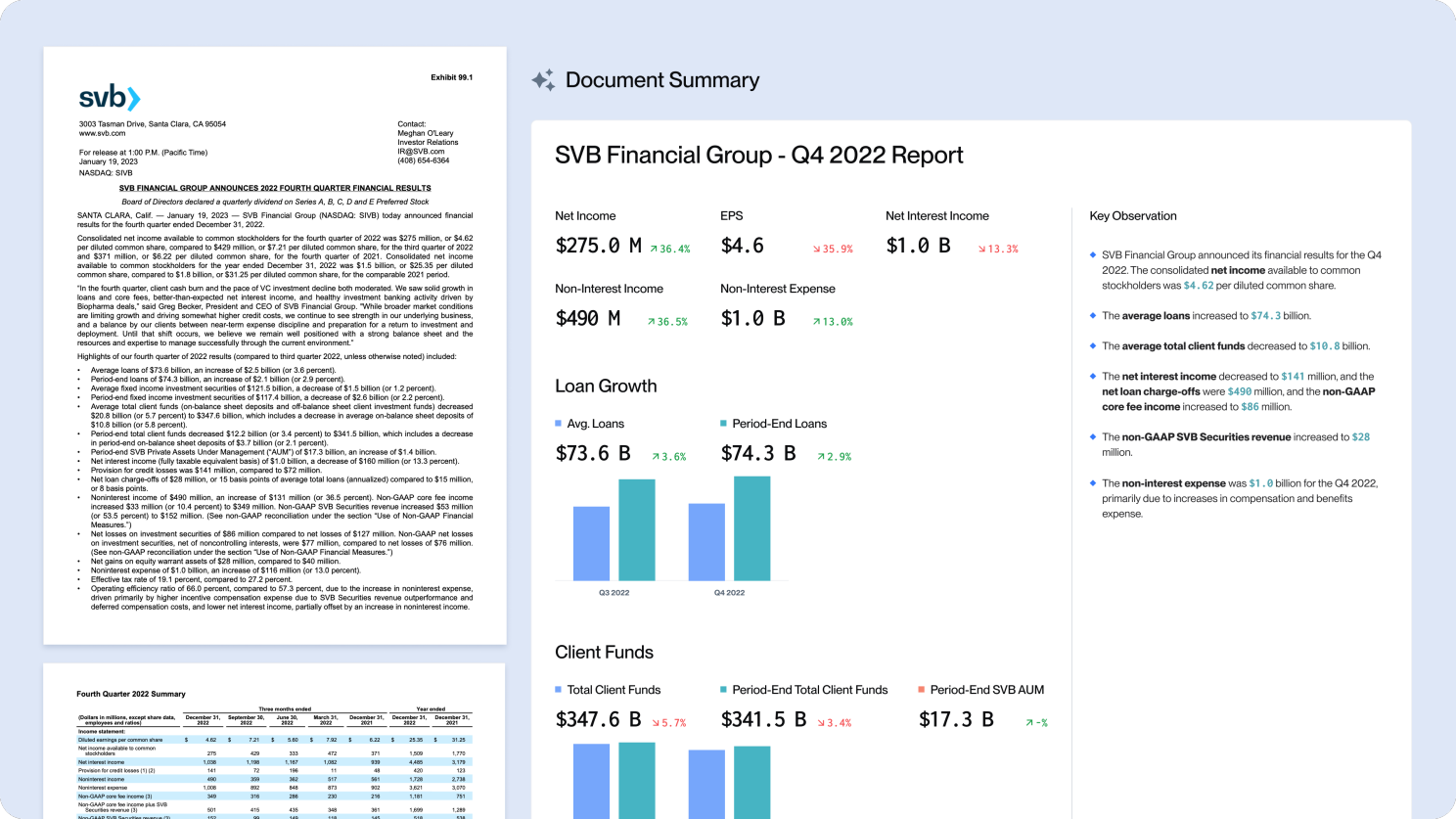

Automated Data Summarisation

Generative AI is being leveraged to automate the summarisation of complex financial documents, which significantly aids investment decisions by distilling essential information from vast datasets. For example, the Policy-Insider.AI platform uses generative AI to summarise documents and provide condensed information that enables users to quickly grasp key details without having to look into the entire content.

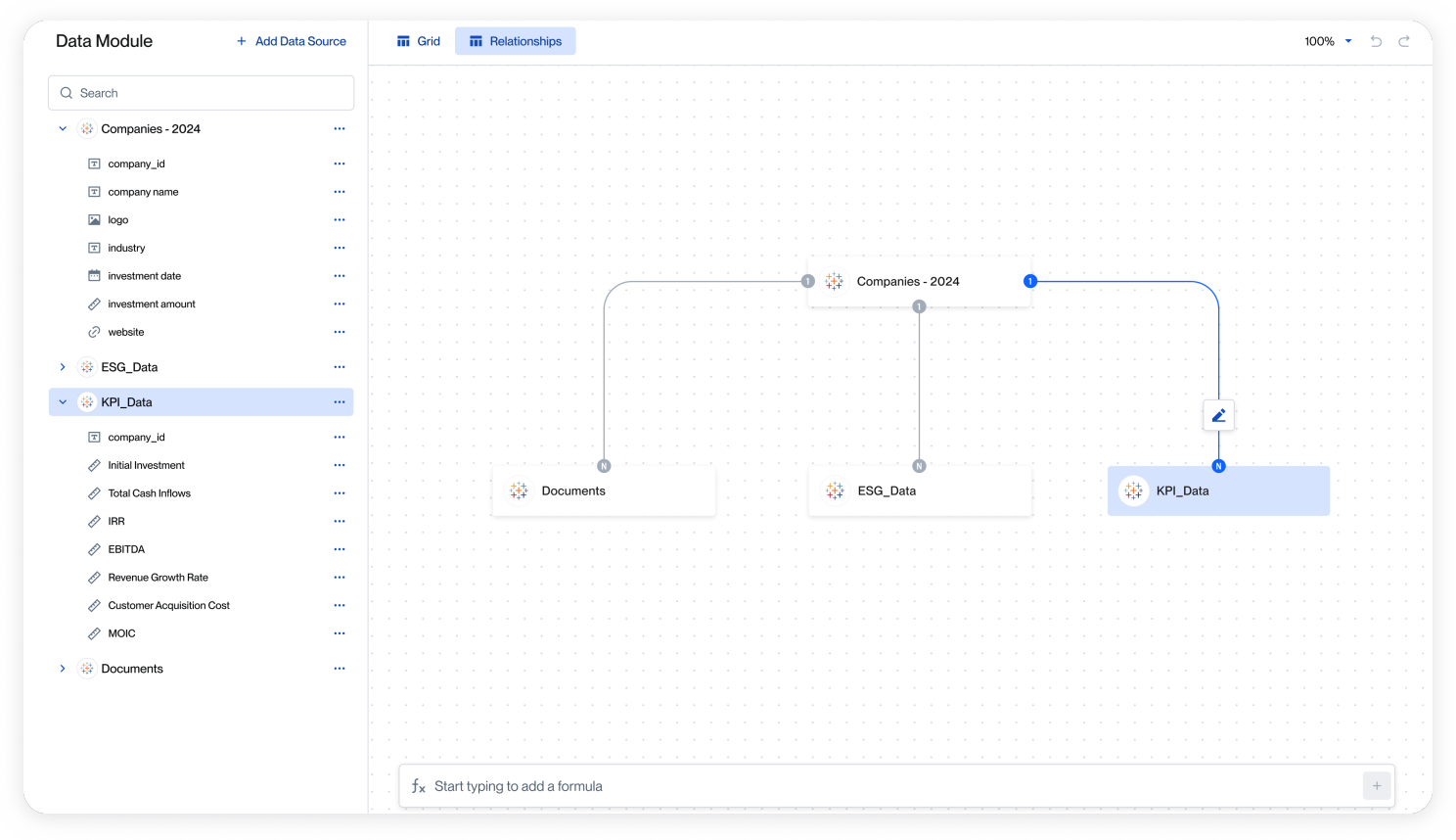

Streamlined Data Integration

AI enhances data integration, allowing for seamless connections between multiple data sources. Deloitte emphasizes the importance of scalable and accessible data repositories that enable fluid data flows, critical for internal and external organizational dynamics. AI-driven tools can automate data integration tasks, which traditionally require extensive manual effort and expertise.

Direct Query Translation

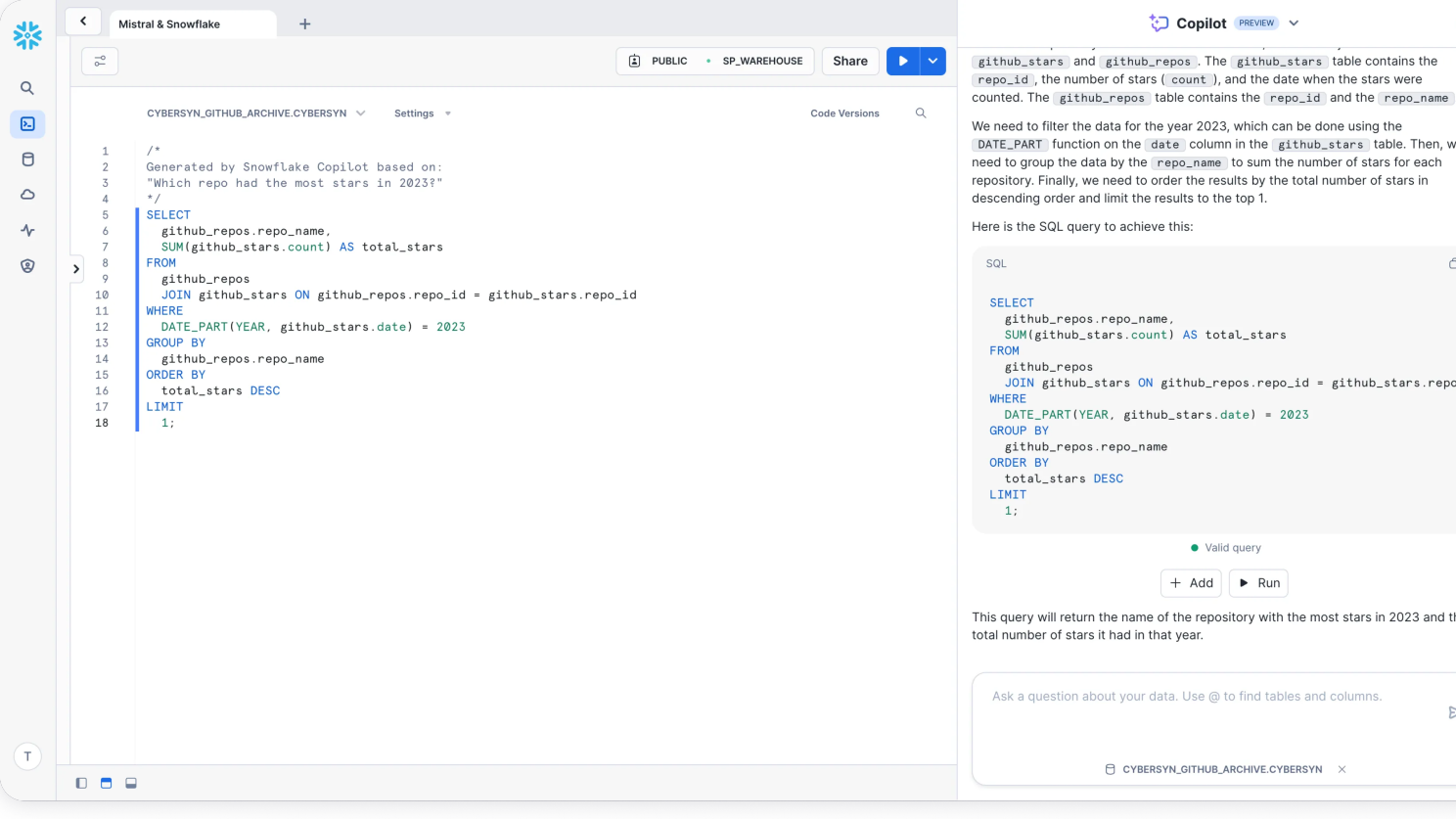

AI technologies that translate natural language queries into data queries allow investors to interact directly with data systems in an intuitive manner. This capability is particularly useful for fast-paced decision-making environments, where time is of the essence. Mistral and Snowflake published an example of a Text-to-SQL implementation in their recent post.

Trend Identification and Anomaly Detection

AI not only streamlines data handling but also proactively identifies trends and detects anomalies. This predictive capacity ensures that investment strategies are both informed and timely, leveraging real-time analytics and AI simulations to anticipate market movements before they happen.

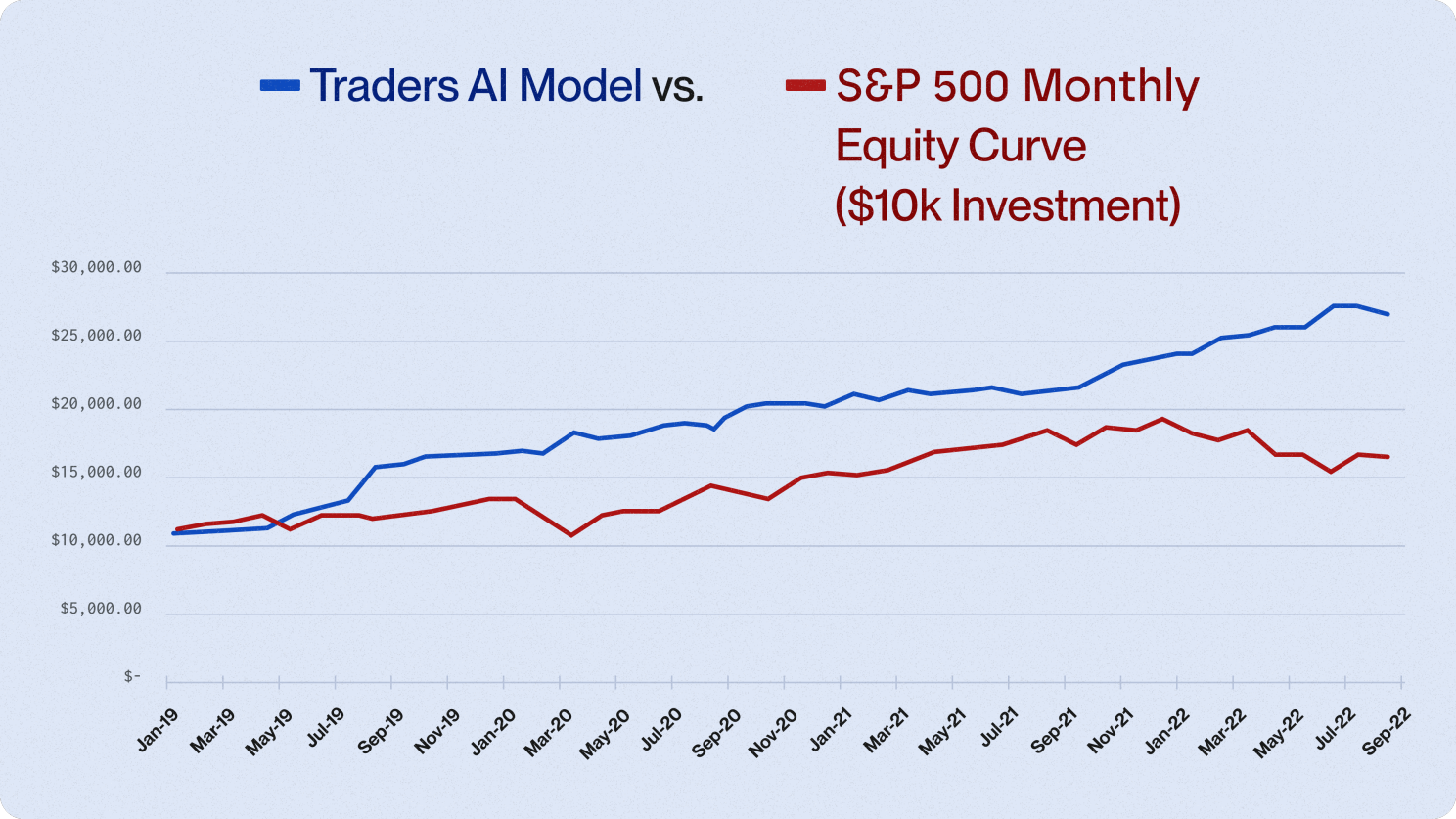

For example, one specific AI model used in equity trading has demonstrated its capability to effectively predict market downturns more accurately than upswings. It has been particularly successful on high-volatility days, opting not to trade on days anticipated to have high risk, thus avoiding potential losses. This model has shown that it can outperform the market, especially during bear market conditions, by generating excess performance relative to the broader market indices.

Conclusion

The integration of AI with strategic data management practices is transforming the investment landscape. By automating and refining the data management process, AI empowers investors to navigate complex, data-driven environments more effectively. As firms continue to embrace digital transformation, the role of AI will only grow, making it an indispensable tool in the arsenal of modern investors.

As we continue to explore the evolving capabilities of AI in future blog posts, we invite you to follow our blog. Here, we will expand on these use cases and offer deeper insights into how AI can further revolutionize your day-to-day workflows.