ESG is no longer just a matter of ethical responsibility, but a strategic move that can significantly enhance portfolio EBITDA. By focusing on sustainability, private equity firms can drive operational efficiencies, unlock new revenue streams, mitigate risks, and attract top talent. In this article, we look at real use cases of ESG integration, supported examples, and recent data:

Source: https://www.accenture.com/us-en/blogs/business-functions-blog/private-equity-esg

Operational Efficiency and Cost Savings

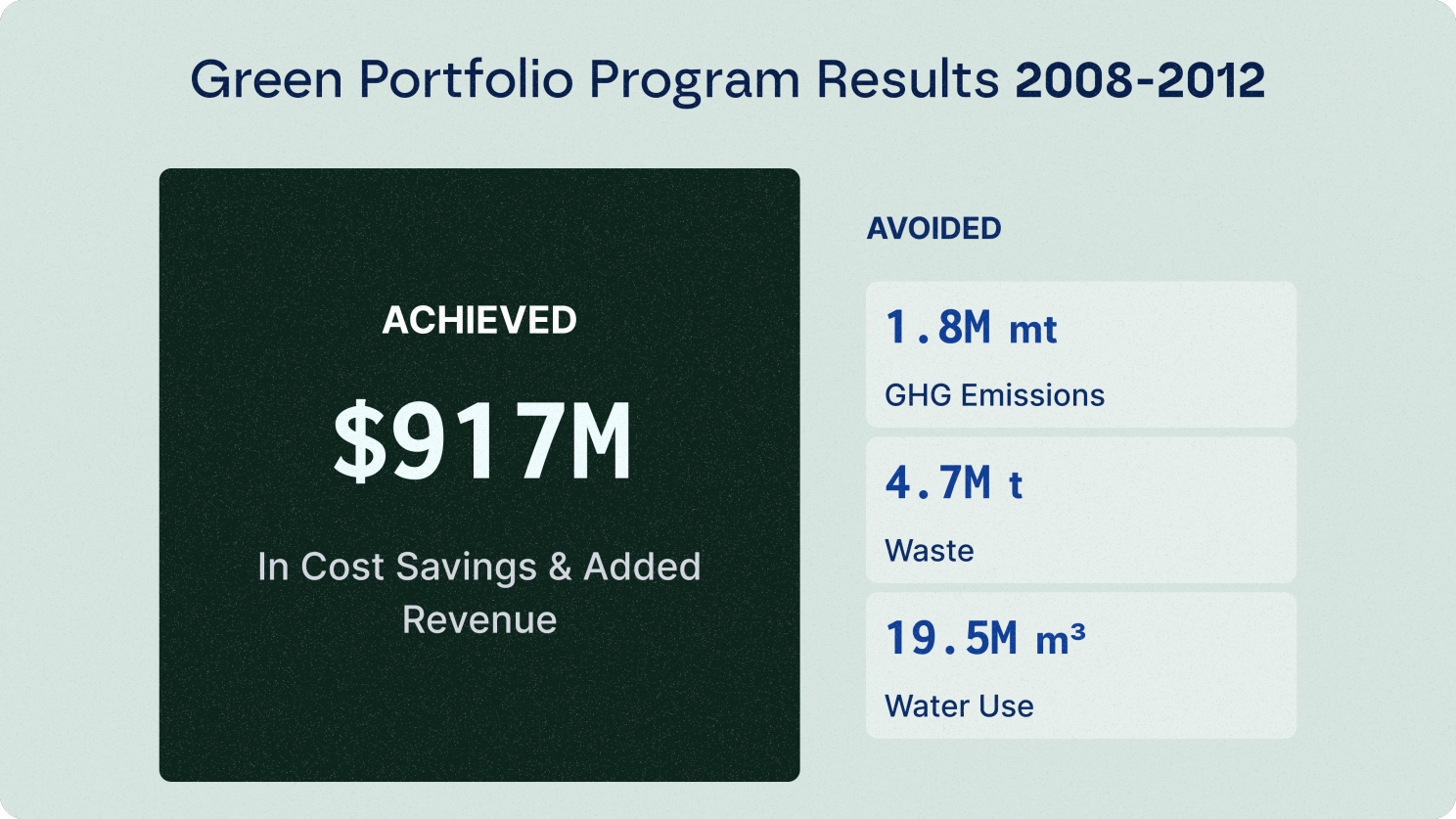

ESG initiatives often lead to substantial cost reductions through improved operational efficiencies. KKR’s Green Portfolio Program, for instance, has been a standout example, achieving over $644 million in cost savings and significant reductions in greenhouse gas emissions, waste, and water usage - in just 4 years. These efforts not only benefit the environment but also enhance EBITDA margins across their portfolio companies by identifying and implementing sustainable practices.

Case Study: Dollar General and Pets at HomeDollar General, a participant in KKR’s program, reduced waste by 74% and added $80 million to its bottom line through cost savings and recycling revenue. Pets at Home saved $1.8 million in fuel costs by improving fleet management and reducing emissions (Bain).

Enhanced Revenue Growth

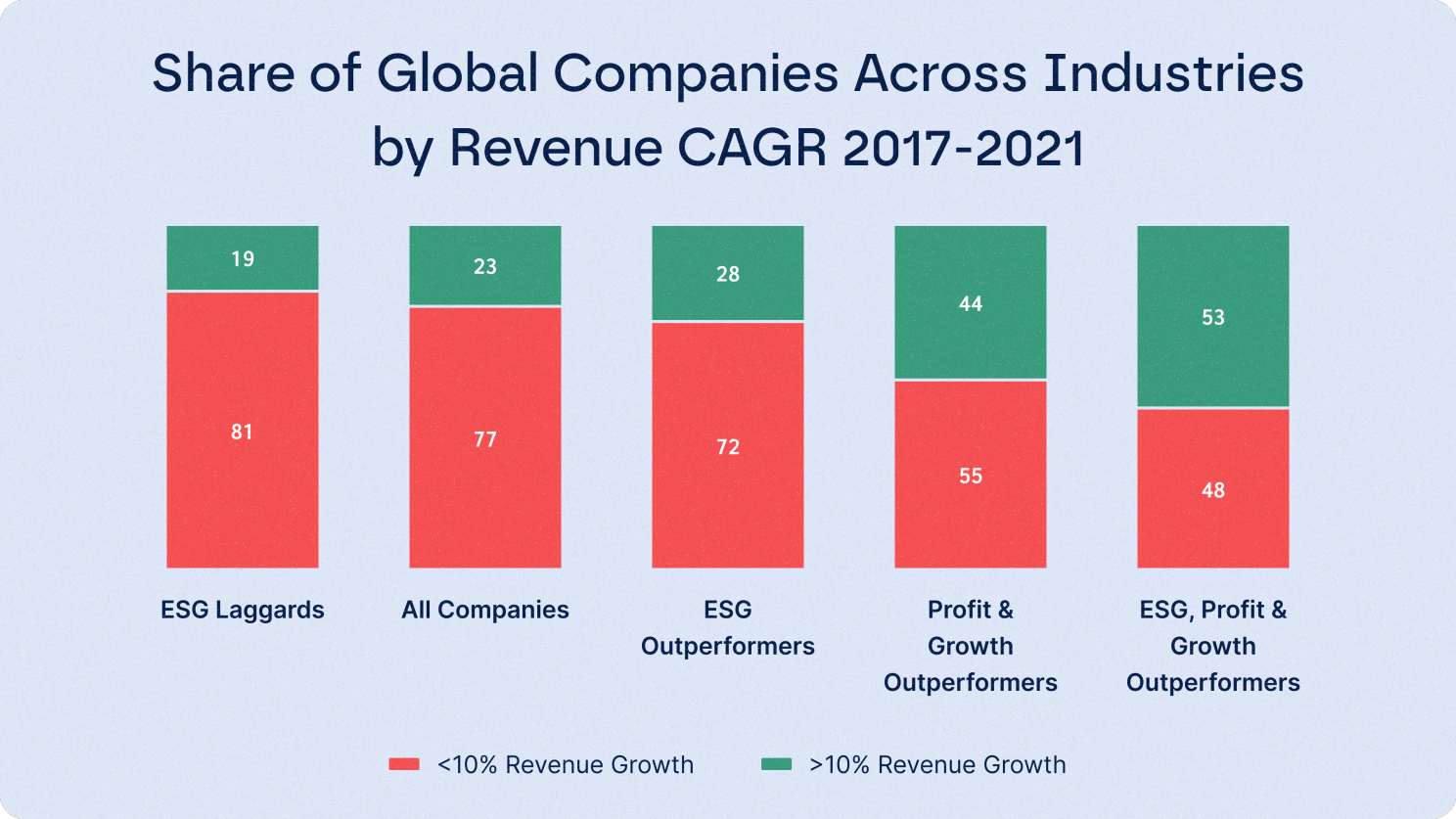

Companies that prioritize ESG can open new markets and attract more customers, leading to increased revenue. According to McKinsey, companies identified as "triple outperformers" (those excelling in revenue growth, profitability, and ESG) increased their revenues at a median rate of 11% per year, significantly higher than their peers who lagged on ESG factors. These companies also saw better shareholder returns, underscoring the financial benefits of robust ESG integration.

Case Study: HolcimHolcim's green growth strategy in building materials is a prime example. Through bolt-on acquisitions of eco-friendly service providers like Malarkey Roofing Products and PRB Group, Holcim significantly enhanced its solutions and products division. This strategic move not only expanded their market offerings but also contributed to a surge in net sales from sustainable products and services.

Risk Mitigation

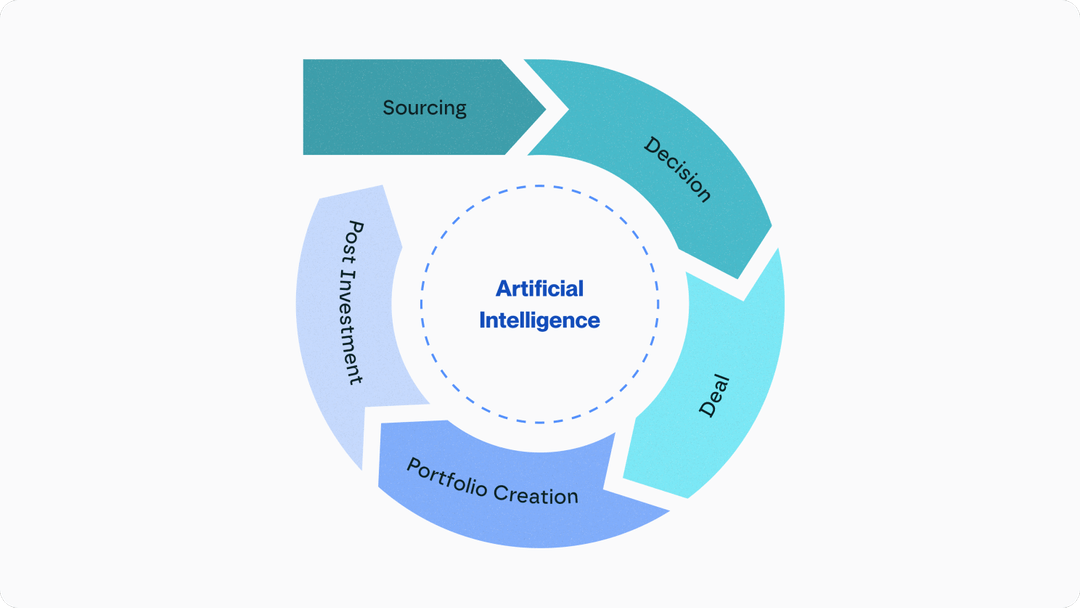

ESG integration helps in identifying and mitigating risks, thereby protecting companies from potential regulatory fines, operational disruptions, and reputational damage. Carlyle Group’s systematic incorporation of ESG considerations into their investment process has enhanced risk management and operational stability across their portfolio companies.

Case Study: Carlyle GroupCarlyle’s investment in Veyance Technologies included a focus on reducing the environmental footprint, resulting in cost savings and improved operational performance. This approach significantly boosted EBITDA, showcasing the financial advantages of sustainability (Carlyle). In fact, Carlyle integrate ESG into the foundations of its financials - dedicating a whole portion of their annual report to ‘The EBITDA of ESG’.

Talent Attraction and Retention

Strong ESG practices make companies more attractive to top talent. Employees increasingly seek employers whose values align with their own. Blackstone, for example, has improved employee satisfaction and retention by implementing comprehensive ESG policies, thereby reducing turnover costs and enhancing overall productivity (EY US).

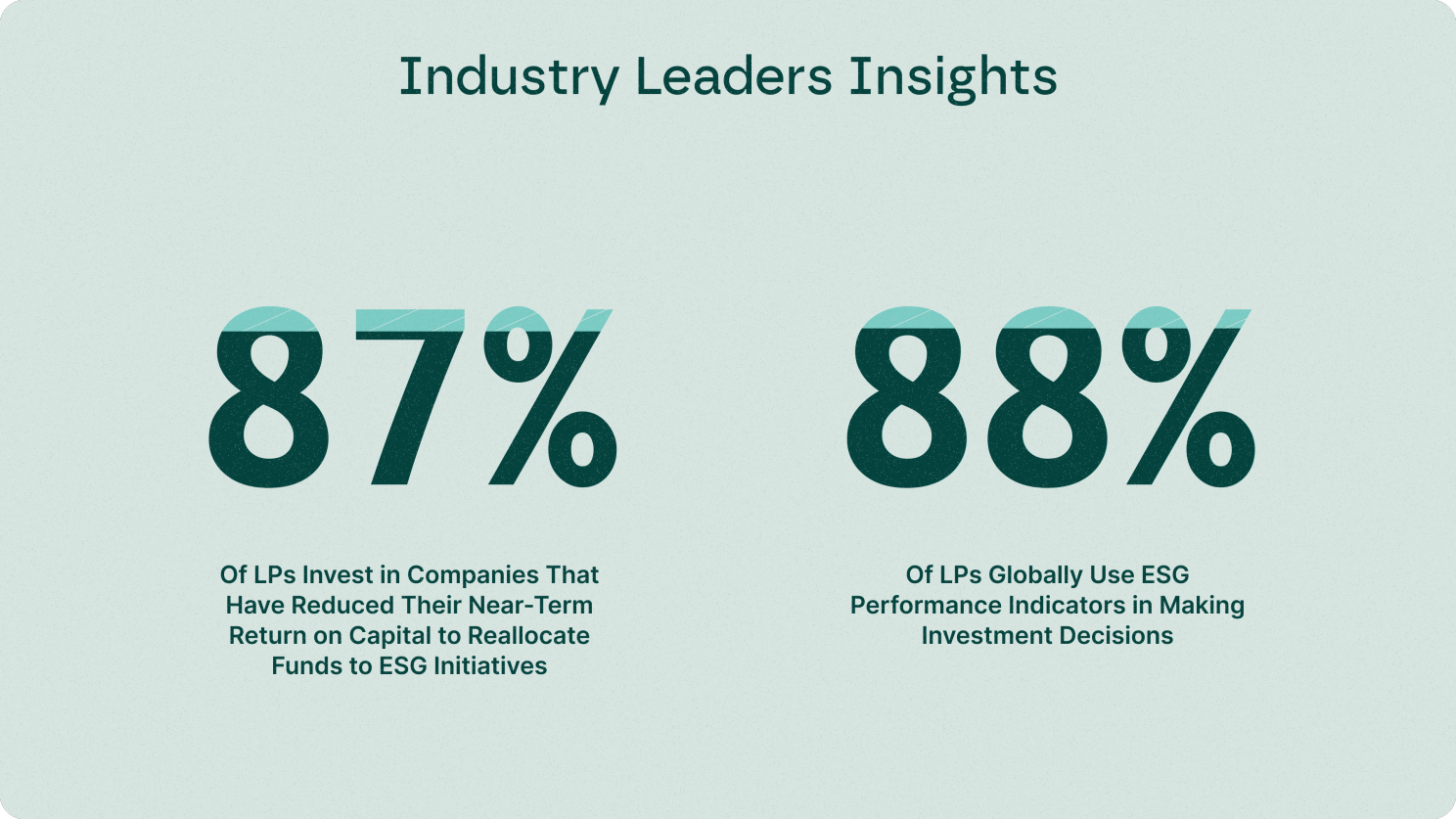

Insights from Industry Leaders

According to the 2020 Edelman Trust Barometer Special Report: Institutional Investors, 88% of limited partners (LPs) globally use ESG performance indicators in making investment decisions, and 87% said they invest in companies that have reduced their near-term return on capital to reallocate funds to ESG initiatives. This trend highlights the increasing importance of ESG in the investment decision-making process and its potential impact on financial performance.

Bain & Company's 2021 Global Private Equity Report reinforces this perspective, noting that proactive firms are not waiting for long-term return on investment (ROI) studies to integrate sustainability and social responsibility into their operations. Firms like TPG are leading the way by launching impact funds and incorporating ESG principles both internally and within their portfolios (Bain).

Ernst & Young (EY) also highlights the importance of ESG in private equity, emphasizing that firms leveraging the "ESG premium" can enhance their competitive positioning, secure more efficient financing, and drive long-term value creation. EY's research indicates that addressing ESG factors can improve a company’s balance sheet and overall financial well-being, which is increasingly recognized by investors (EY US).

Conclusion

ESG integration is a strategic imperative that can significantly enhance portfolio EBITDA. By improving operational efficiency, driving revenue growth, mitigating risks, and attracting top talent, ESG initiatives deliver substantial financial benefits.

For private equity investors, the message is clear: integrating ESG into investment strategies is not just good for society and the environment; it is also good for business. By adopting a proactive and strategic approach to ESG, investors can unlock new growth opportunities, enhance profitability, and ensure sustainable success.